Young Korean investors choose monthly dividend ETFs over crypto

Once seen as a financial instrument for older investors, dividend-type ETFs are popular among MZers seeking a steady income

By Jul 22, 2024 (Gmt+09:00)

China bans export of Korean goods containing its rare earth metals to US

StockX in merger talks with Naver’s online reseller Kream

LG Chem to sell water filter business to Glenwood PE for $692 million

Korean hotels bask in rising foreign visitors; travel agencies in trouble

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

For decades, investments in financial products that promise decent dividend payouts such as high-dividend stocks have been associated with elderly investors, including pensioners, who want to enjoy a leisurely life with stable cash flow after retirement.

In recent years, however, young investors, including millennials or MZers, are willing to put their money into such products, particularly ones that dole out monthly dividends, weaning themselves off short-term investment instruments such as cryptocurrencies.

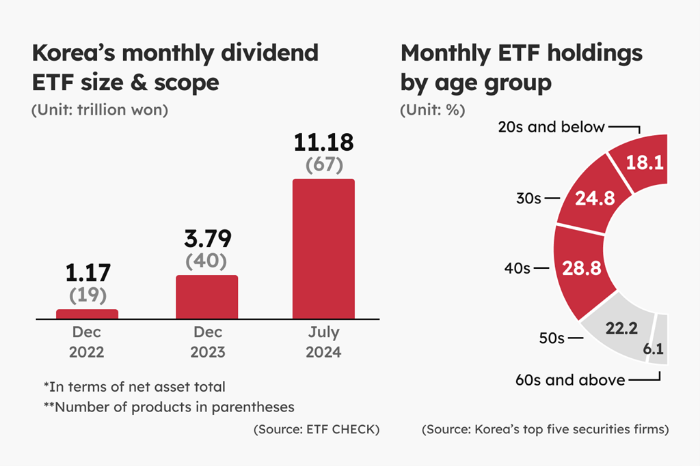

According to a recent analysis of five domestic securities firms’ data by The Korea Economic Daily (KED), their monthly dividend-paying exchange-traded fund (ETF) assets stand at 11.36 trillion won ($8.2 billion) – a 10-fold increase from 1.17 trillion won at the end of 2022.

The number of monthly dividend ETF products sold by the five brokerages has risen to 67 from 19 over the same period.

The five brokerage houses are Mirae Asset Securities Co., NH Investment & Securities Co., Samsung Securities Co., Hana Securities Co. and Shinhan Securities Co.

Of 605,575 retail investors who own at least one monthly dividend ETF traded on the Korea Exchange, those in their 40s or younger accounted for 71.7%, the KED analysis showed.

By age group, individual investors in their 40s accounted for 28.8%, followed by people in their 30s (24.8%), those in their 50s (22.2%) and twentysomethings or younger (18.1%).

Investors in their 60s or older accounted for only 6.1%.

Korean retail investors who turn their eyes overseas for higher returns, or “Seohak Ants” as some pundits call them, showed similar investment patterns.

Those Seohak Ants in their 40s or younger owning monthly dividend ETFs from the US market accounted for 74.1% of the entire such Korean ETF buyers in the US.

NEW INVESTMENT TOOLS FOR THE YOUNG

In recent years, the younger nouveau riche, or the young rich, armed with high financial literacy, have often amassed wealth through aggressive, highly leveraged stock and cryptocurrency investments.

However, a wind of change is blowing as some young investors, who want to retire early to enjoy life with a stable income, are turning their sights toward dividend-type investments, analysts said.

“Some young investors prefer a steady stream of income such as monthly dividends over making money quickly,” said Park Soo-min, head of the ETF product strategy team at Shinhan Asset Management Co.

On YouTube or other online investment communities, monthly dividend ETFs are a hot topic among millennials and MZers, industry officials said.

“Last year, many people my age showed interest in stocks seen rising rapidly over the short term, such as battery shares. But recently, they are more interested in high-dividend shares and monthly dividend-paying ETFs,” said a Korean ETF investor in his 20s.

US DIVIDEND ETF IN HIHG DEMAND

According to the Korea Exchange, Korea’s main market operator, about half of the top 10 ETF products unveiled this year were dividend-type.

With the growing popularity of dividend ETFs, asset managers are selling a diverse portfolio of such ETFs that include products such as covered call options or real estate investment trusts (REITs) instead of just selling simple ETFs with high-dividend stocks.

In the US, financial products such as JPMorgan Equity Premium Income ETF (JEPI) and JPMorgan Nasdaq Equity Premium Income (JEPQ) were among the most purchased by retail investors.

According to the Korea Exchange, the monthly dividend ETF most purchased by Korean retail investors so far this year is TIGER US Dividend Dow Jones, amounting to a net purchase of 582.5 billion won. The ETF’s average annual dividend growth rate over the past decade reached 13%.

The "TIGER US Tech TOP 10+10% Premium" ETF, launched in January, boasts a six-month return of 30.54%.

Despite the growing interest in monthly dividend-type ETFs among young investors, however, analysts warned that they should use extra caution in their investment behavior.

“There’s no free lunch in the investment industry. Monthly dividend ETFs look like a cover-it-all instrument that targets both growth and high dividends. However, just like any other ETFs, you can lose a considerable part of your principal with such ETFs once stocks turn south and sharply fall,” said an asset management firm executive.

Write to Byeong-Hun Yang, Man-Su Choi and Jin-Gyu Maeng at hun@hankyung.com

In-Soo Nam edited this article.

-

Asset managementSouth Korean brokerages woo super-rich to make them even richer

Asset managementSouth Korean brokerages woo super-rich to make them even richerJul 02, 2024 (Gmt+09:00)

3 Min read -

Asset managementSamsung Asset eyes expansion into US ETF market

Asset managementSamsung Asset eyes expansion into US ETF marketApr 23, 2024 (Gmt+09:00)

2 Min read -

Asset managementMirae Asset, Bloomberg to team up to develop ETFs

Asset managementMirae Asset, Bloomberg to team up to develop ETFsFeb 15, 2024 (Gmt+09:00)

1 Min read -

Korean stock marketKorean investors’ risky bet: Buy inverse ETFs as Kospi heads higher

Korean stock marketKorean investors’ risky bet: Buy inverse ETFs as Kospi heads higherJun 05, 2023 (Gmt+09:00)

3 Min read -

Korean stock marketTIGER KEDI30 ETF tops Korean retail investors’ themed stock buy list

Korean stock marketTIGER KEDI30 ETF tops Korean retail investors’ themed stock buy listDec 27, 2022 (Gmt+09:00)

2 Min read -

Korean stocks end at highest level in 2 years as ants load up

Korean stocks end at highest level in 2 years as ants load upAug 05, 2020 (Gmt+09:00)

2 Min read -

Korean retail investors attracted to US growth stocks, now 10th Tesla owners

Korean retail investors attracted to US growth stocks, now 10th Tesla ownersAug 31, 2020 (Gmt+09:00)

4 Min read