US multifamily market challenges create investment opportunities

There are opportunities for distressed assets in the US multifamily housing sector over the next 12-18 months, Vance Voss says

Apr 30, 2024 (Gmt+09:00)

Deutsche Bank's Korea IB head quits after country head resigns

Macquarie Korea Asset Management confirms two nominees

Hanwha buys SŌĆÖpore Dyna-MacŌĆÖs stake for $73.8 mn from Keppel

Korea's Taeyoung to sell local hotel to speed up debt workout

Meritz leaves door open for an M&A, to stay shareholder friendly

There is potential distress in the U.S. multifamily housing sector today. ┬Āwe believe there is a window of opportunity over the next 12-18 months for well-capitalized investors to take advantage of select distress opportunities and to exit when capital values have recovered in three to five years, optimizing returns. Investors with dry powder at the ready will be in a prime position to enter this narrow window of opportunity.

Prior to the pandemic, overdevelopment in the multifamily sector was a cause for concern among investors. When the pandemic hit, new development projects and those already underway were delayed due to work restrictions, supply chain constraints, and labor shortages.

But by 2021, pent-up demand and capital appreciation caused a new surge in development, exacerbating existing supply concerns.

LOWER TRANSACTION VOLUME

Another pain point for the multifamily sector in 2023 was the confluence of high inflation and interest rate increases. As consumer inflation reached its highest level since the early 1980s following the pandemic, the Federal Reserve began increasing interest rates to stem the rapid increase in prices.

The disruption this caused in capital markets brought commercial real estate transactions to their lowest level since the Global Financial Crisis (GFC). Apartment transaction sales volume was down 65% in 2023. In 2024, we see some room for improvement, as investors are more confident that the FedŌĆÖs tightening cycle is nearing completion, facilitating better clarity on pricing.

DECLINING VALUES

Driven by capital market uncertainty, apartment values are down 14.7% from their peak in Q3 2022 through the end of 2023ŌĆömuch less than during the GFC but still quite significant. We expect values to further decline in the first half of 2024.

MULTIFAMILY DISTRESS

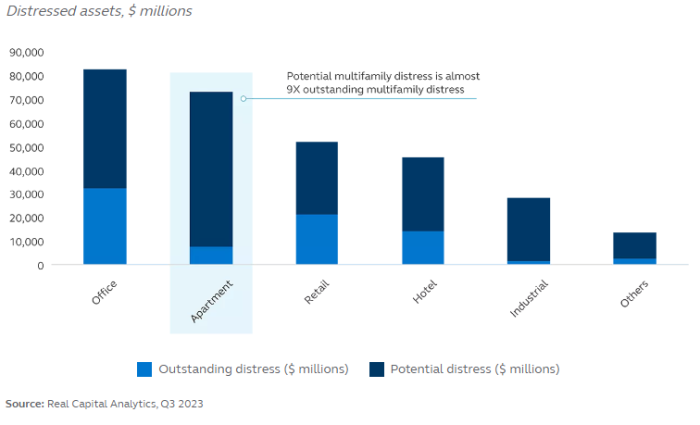

The high levels of development, lack of a fully functioning transaction market, and declining values have conspired to pressure weaker developers and operators within the multifamily sector. As shown in the chart below, while outstanding apartment distress comprises less than 10% of total commercial real estate distress, potential distress comprises nearly a third of the entire market.

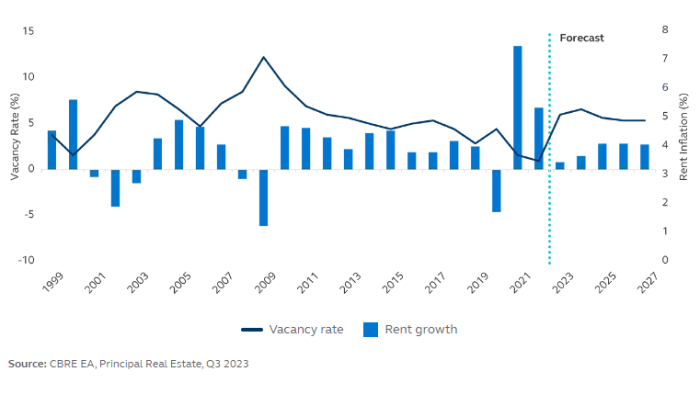

Apartment fundamentals are in the process of resetting after a stellar run. While rental rates fell during 2020 by 5%, they increased by 20% over the following two years as the chart below.

Partially as a result of outsized rent growth following the pandemic, rental affordability has come into focus. In fact, the median renter is now rent-burdened, as more than 30% of their total income needs to be used to pay for shelter costs. This has had the effect of slowing both the pace of the net absorption of apartment units and the ability of landlords to push for more robust increases on in-place leases.

While vacancy rates have increased over the past 12 months, they remain below their long-term historical trends, which we expect to help rental growth to return to its historical norms in 2026 and beyond. This will be driven by a moderation in new development starting in 2025, at a time when demand is in lockstep with economic growth and household formation.┬Ā

We believe that 2024 will be a pivotal year for the multifamily sector. While values and market fundamentals regain their footing, the maturity schedule will prove daunting. In total there is roughly $500 billion in apartment loans set to mature by the end of 2024, by far most of any sector over the same time period. The multifamily sector represents 45% of the total loans set to mature across all sectors.

Given lower transaction volumes and values well below their previous peak, the wave of maturities could force many owners to sell at a discount. The increased cost of capital and a valuation decline have made it nearly impossible for some operators to recapitalize today.┬Ā

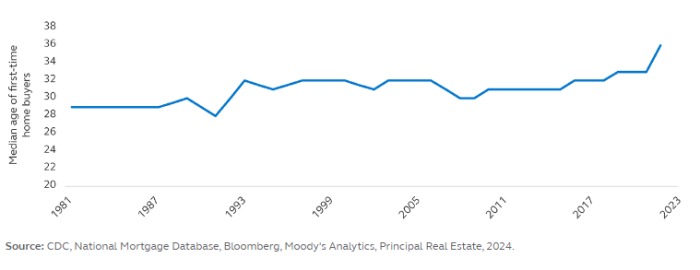

The economics of the residential sector has shifted dramatically over the past decade. Affordability remains a key constraint to accessing the purchase market. The younger generations which make up a large part of the population ŌĆō Millennials and Gen Z ŌĆō are renting or living at home longer than their parents did.

There are several reasons influencing the delay in home purchases. For starters, younger generations tend to be more prone to inter-city and regional movements than prior generations, which promotes mobility.

Not only do younger generations rent longer by choice but the mortgage interest rates that followed the GFC and pandemic have put downward pressure on the affordability of the single-family purchase market. Consequently, homeownership rates among key demographics have lagged, which is creating a large source of potential demand for rental units. Moreover, these younger generations are currently in the primary renter cohorts.

OPPORTUNITY FOR MULTIFAMILY INVESTORS

The multifamily sector faces several challenges over the next 12 months. Market fundamentals have weakened, and demand is reverting to its historical norms at a time when construction remains at near record levels.

Combined with a higher interest rate environment, which we expect to persist over the longer run, weaker and less well-capitalized operators will face increased pressure to look for an exit strategy.

We believe that in the next 12-18 months, well-funded investors can take advantage of the distress and exit when capital market appreciation is firmly in recovery in three to five years, realizing opportunistic-like returns.

By Vance Voss, managing director and portfolio manager of Principal Real Estate

He joined the firm in 1991. He received an MBA in Finance from University of Minnesota and a bachelor's degree in Business Administration from Grand View University. Vance served on the board of directors for the US Green Building Council.

Jennifer Nicholson-Breen edited this article.

-

InfrastructureCompelling investment opportunity in US data center market: Principal

InfrastructureCompelling investment opportunity in US data center market: PrincipalNov 23, 2023 (Gmt+09:00)

3 Min read -

Real estatePrincipal opens Seoul office to intensify client relationships

Real estatePrincipal opens Seoul office to intensify client relationshipsOct 22, 2022 (Gmt+09:00)

2 Min read -

Real estateDevelopment will outperform in post-COVID era: Principal Real Estate

Real estateDevelopment will outperform in post-COVID era: Principal Real EstateJul 22, 2022 (Gmt+09:00)

long read -

Alternative investmentsData centers in European core cities are promising, Principal head says

Alternative investmentsData centers in European core cities are promising, Principal head saysMar 16, 2022 (Gmt+09:00)

7 Min read