Business & Politics

Biden exempts graphite from EV mineral sourcing rule in win for Korea

Seoul has called on Washington to accept its request for a flexible timeframe regarding IRA sourcing requirements

By May 05, 2024 (Gmt+09:00)

3

Min read

Most Read

Deutsche Bank's Korea IB head quits after country head resigns

Macquarie Korea Asset Management confirms two nominees

Hanwha buys SŌĆÖpore Dyna-MacŌĆÖs stake for $73.8 mn from Keppel

Korea's Taeyoung to sell local hotel to speed up debt workout

Meritz leaves door open for an M&A, to stay shareholder friendly

WASHINGTON, D.C. ŌĆō The US government has given automakers additional flexibility on battery mineral requirements, allowing electric vehicles with batteries containing graphite sourced from China to be eligible for tax credits until the end of 2026.

South Korea, home to the worldŌĆÖs leading battery makers LG Energy Solution Ltd., Samsung SDI Co. and SK On Co., welcomed the US decision, heralding it as a win for Korean and other global automakers and battery manufacturers.

According to the US Federal Register on Friday, the Treasury Department released the formal regulation for consumer EV credits alongside the final criteria for sourcing battery minerals ŌĆō namely, what canŌĆÖt come from China.

Under the finalized rules, the US Treasury said it would give automakers until 2027 to remove some hard-to-trace minerals like graphite contained in anode materials and critical minerals contained in electrolyte salts, binders and additives.

The Treasury said that graphite will be considered ŌĆ£impracticable-to-traceŌĆØ until then as the current graphite supply chain involves mixing natural and synthetic materials and synthetic graphite is made from crude oil thatŌĆÖs hard to trace.

Under existing US guidelines, trace critical minerals from China and other countries deemed a Foreign Entity of Concern (FEOC), including North Korea, Russia and Iran, were ineligible for US tax credits stipulated by the Inflation Reduction Act (IRA).

The US government now says that graphite will be temporarily exempt from FEOC compliance until 2027 as long as EV makers and battery firms demonstrate how they plan to comply by then.

REALITY CHECK

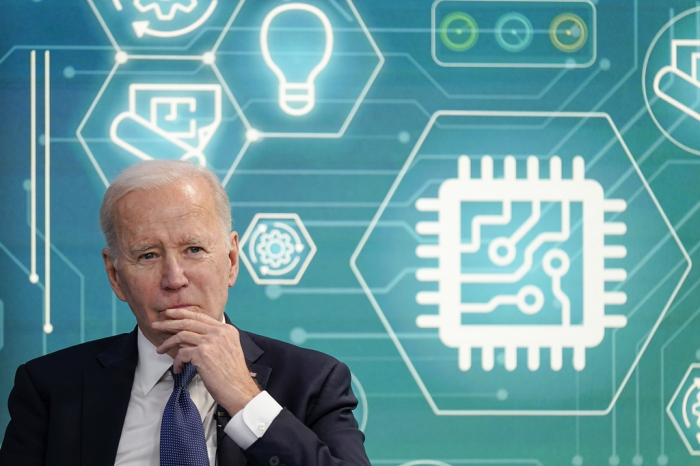

Analysts said the new Treasury rules appear to recognize the realities of the global supply chain as the Joe Biden administration hopes for faster US consumer adoption of electric cars.

The IRA grants qualifying EV buyers up to $7,500 per vehicle if the clean car is assembled in the US and the batteryŌĆÖs minerals are mined or processed in the US or countries with free trade agreements with Washington.

The IRA rules are designed to wean the US EV battery chain away from China. However, automakers and battery makers have struggled to meet strict sourcing requirements.

China currently accounts for 70% of the global output of graphite, used to make electric battery anodes, the negatively charged portion of the battery.

To be eligible for US tax benefits, KoreaŌĆÖs top automaker Hyundai Motor Co. and battery maker LG Energy Solution have promised heavy investments to build their plants in the US.

LG Energy, the worldŌĆÖs No. 2 battery maker after ChinaŌĆÖs CATL, said last year it would invest 7.2 trillion won ($5.6 billion) to build a battery complex in Queen Creek, Arizona to meet rising demand for clean cars in North America.

LG also signed battery materials supply deals with Canadian minerals companies to respond to the US tax credit law.

SEOUL WELCOMES US MOVE

South KoreaŌĆÖs Minster of Trade, Industry and Energy Ahn Duk-geun welcomed the US decision, saying in a press release on Saturday that Seoul's efforts to include Korean companies' positions, including one on the graphite issue, in US rules ŌĆ£bore fruit."

Korean automakers and battery firms as well as their rivals in other countries have expressed concerns that it will be difficult to find an alternative supply chain for graphite within the timeframe given under the IRA.

"The Korean government has been actively communicating with the US to maximize benefits for South Korean companies since the enactment of the IRA in August 2022," the ministry said in a statement.

In March 2023, Korea also officially requested the US government review details of the guardrail provisions in the CHIPS and Science Act to ease the rules limiting Korean chipmakersŌĆÖ production capacity in China.

The so-called guardrails are part of WashingtonŌĆÖs efforts to thwart BeijingŌĆÖs chip supremacy ambitions while securing the supply of the components that underpin advanced technologies, including artificial intelligence and supercomputers as well as everyday electronics.

Write to In-Seol Jeong and Sul-Gi Lee at surisuri@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesLGŌĆÖs $5.5 billion LFP, ESS battery plants in Arizona to kick off in 2026

BatteriesLGŌĆÖs $5.5 billion LFP, ESS battery plants in Arizona to kick off in 2026Apr 04, 2024 (Gmt+09:00)

3 Min read -

Corporate strategyPOSCO to comply with IRA rules to access battery tax breaks: chairman

Corporate strategyPOSCO to comply with IRA rules to access battery tax breaks: chairmanJun 01, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsSouth Korea officially asks US to ease chip rules on China expansion

Business & PoliticsSouth Korea officially asks US to ease chip rules on China expansionMay 24, 2023 (Gmt+09:00)

4 Min read -

BatteriesLG Energy in cobalt, lithium deals with three Canadian suppliers

BatteriesLG Energy in cobalt, lithium deals with three Canadian suppliersSep 23, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS Act

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS ActMar 28, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy to build $5.6 billion battery complex in Arizona

BatteriesLG Energy to build $5.6 billion battery complex in ArizonaMar 24, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN