S.Korean LPs to up exposure to private debt, infrastructure in 2023: Survey

Half of the 22 surveyees will increase exposure to alternative assets; more LPs put higher value on GPs' deal sourcing

By Apr 19, 2023 (Gmt+09:00)

MBK’s Korea Zinc bid aimed at corporate governance, shareholder value

S.Korea set to scrap financial investment income tax

In South Korea, cash is king on US election, Samsung uncertainties

NPS commits $436 mn to Koramco, Hana Alternative for real estate lending

South Korea’s Viva Republica drops Korean IPO plan, seeks US debut

The survey was conducted in January of this year for Korea's 22 major institutional investors, including pension funds, mutual aid associations and insurers. Together they manage 2.11 quadrillion won ($1.59 trillion) in assets. Of the 22 investors, 20 manage 411.4 trillion won ($308.9 billion) in alternative assets.

Half of the respondents said they will increase exposure to alternative assets this year. Some 18.2% and 9.1% will hold and reduce the exposure, respectively, while the remaining didn’t respond.

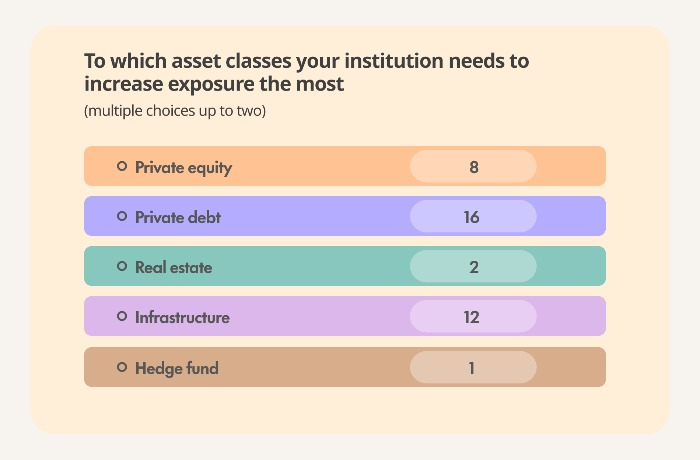

In a multiple-choice question about asset class exposure allowing up to two options, they picked private debt and infrastructure the most to increase.

About 77.3% of the respondents thought private equity is highly or moderately overvalued. Also, 59% said real estate is overpriced.

Some 59% said private debt is fairly valued; some 40.9% said infrastructure is fairly valued, while 45.5% thought the asset class is moderately overpriced.

More Korean limited partners (LPs) picked deal sourcing as a critical factor when selecting general partners (GPs) this year. More than 59% of the respondents said the deal pipeline is very important when choosing an asset management firm, compared with 38.5% for the answer last year.

The survey also showed that Korean institutional investors value the presence of Korean investment relations staff when picking GPs – about 73% of the respondents think having a Korean IR employee is very important or moderately important.

The LPs’ preference for GP selection has remained similar to last year. They chose assets under management, size of funds raised, track record, risk management skills and speed of capital deployment as important factors.

Some factors such as knowledge transfer and the presence of a Seoul office were less important for GP selection, the survey found.

The asset owners have become more skeptical of emerging markets. More than 59% said they can’t invest in emerging market funds, compared with 34.6% last year. Around 32% said they can bet on such funds, similar to last year.

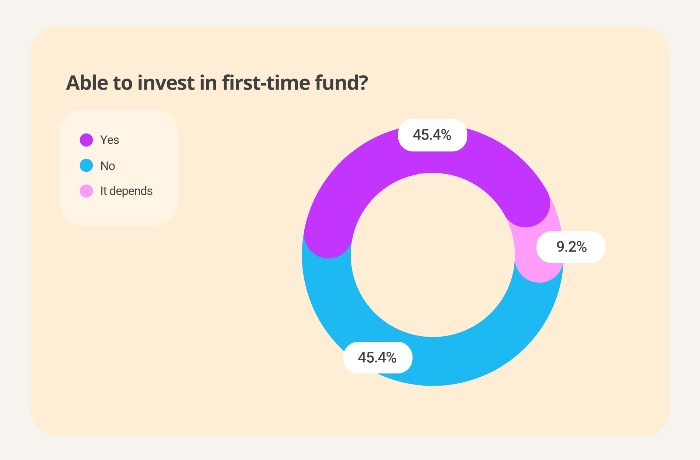

Meanwhile, more institutional investors have become more decisive on first-time funds this year, the survey showed. About 45% said they can bet on first-time funds, up from 27% the last year. Another 45% said they can’t, while about 35% answered they couldn't last year.

To view responses of individual institutions on their alternative asset allocation and fund manager selection, please visit Asset Owners Report.

Participants in this survey are as follows:

Public pensions and SWF

National Pension Service

Korea Investment Corporation

Government Employees Pension Service

Teachers' Pension

Korea Post (Insurance)

Mutual aids & associations

Yellow Umbrella Mutual Aid Fund

Military Mutual Aid Association

Public Officials Benefit Association

Korean Federation of Community Credit Cooperatives

The Korean Teachers' Credit Union

Insurers

Kyobo Life Insurance

Samsung Life Insurance

NongHyup Life Insurance

NongHyup Property and Casualty Insurance

Meritz Fire & Marine Insurance

Samsung Fire & Marine Insurance

Shinhan Life Insurance

Hanwha Life Insurance

Hyundai Marine and Fire Insurance

ABL Life Insurance

KB Insurance

KB Life Insurance

Write to Jihyun Kim at snowy@hankyung.com

Jennifer Nicholson-Breen edited this article.

-

Korean Investors88% of Korean LPs want speedy capital deployment

Korean Investors88% of Korean LPs want speedy capital deploymentFeb 23, 2022 (Gmt+09:00)

3 Min read -

Korean InvestorsS.Korean LPs name 41 best alternative asset managers

Korean InvestorsS.Korean LPs name 41 best alternative asset managersMar 21, 2023 (Gmt+09:00)

long read